You’ve probably heard about how amateur investors on Reddit trounced short-selling hedge fund investors by buying stocks like GameStop (GME), AMC Entertainment Holdings (AMC), and Nokia (NOK), but what you may have missed in the news cycle is that these were only a few representative stocks.

You’ve probably heard about how amateur investors on Reddit trounced short-selling hedge fund investors by buying stocks like GameStop (GME), AMC Entertainment Holdings (AMC), and Nokia (NOK), but what you may have missed in the news cycle is that these were only a few representative stocks.

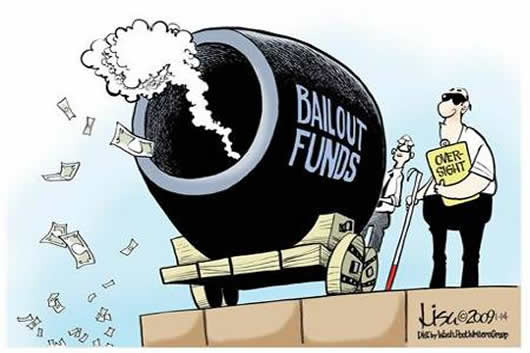

These stocks were highlighted because they epitomized the profile of overvalued and underperforming stocks for market manipulation selected by the Wall Street traders. Noticing this trend by the hedge fund managers to short these types of vulnerable stocks, the Reddit group, going by the moniker WallStreetBets, launched a counterplay by going long and buying at-risk stock in droves.

There were many other stocks caught in the dragnet and some other notable stocks that benefited from the main street “bailout” were Bed Bath & Beyond (BBBY), BlackBerry (BB) Express (EXPR), Palantir Technologies (PLTR), and Plug Power (PLUG).

Although you may have missed out on this unprecedented opportunity to revitalize your finances (some retail investors were able to pay off their student loans with their profits), here are some ways to prepare for any future investment opportunities.

Review Your Debt Repayment Process

If you have more debt than money in the last week of the month, it might not be because you’re not earning enough, but because you’re spending most of your money repaying your credit card debts. Rather than hoping to figure out a way to pay off a larger chunk of your debt at a quicker rate as a way to cut down on how much you’re paying on high interest, try a more effective debt repayment process — pay off all your debts with a consolidated loan.

Many independent financial lenders specialize in offering consolidated loans to pay off credit card debt, make it easy to apply for and get an unsecured loan to put your credit card debts behind you. Since these loans are based on a fixed rate and since they can be set up as long-term loans, you’ll pay less on the total interest on your loans and also pay a smaller amount each month.

If acquiring a debt consolidation loan is a struggle, consider applying for a starter loan. It’s a short-term loan of up to $2,000 for qualified applicants. You can reduce or eliminate credit card accounts with high interest rates by using the upfront funds to pay down balances.

One of the most significant advantages to using a starter loan is that it can also help establish or improve your credit history. As long as the funds are repaid in a timely manner it will reflect positively on your credit reports. With time, these positive payments raise your credit score.

Rethink Your Approach to Finances

Although you recognize that your financial situation is not what you want, you may have attributed it to working for the wrong corporation, choosing the wrong career path, or being an accidental casualty of a bad economy, an economy compromised by the pandemic and the pandemonium of socioeconomic factors.

While you may or may not be correct in your assessment of why your finances are not on par with your expectations, a more helpful approach would be to focus on issues within the sphere of your influence.

First, notice where your money goes every month. How much are you earning in relation to your monthly expenses? How much are you spending in relation to your earnings? How much are you saving for an emergency account or saving to build capital for future investments? How much do you know about investments to generate passive income, putting your money to work for you?

Second, make new decisions on how you’ll improve your finances. If you are under-earning, design a plan to increase your professional skills. If you only have a rough estimate of your expenses, create a budget to allocate where every dollar should when you get your paycheck. If you are spending all your money every month on unessential things that only provide fleeting satisfaction, start a savings account.

Third, take action on your intention to master new financial habits. Learn how to do the things that you want to do. Also, once you’ve rolled out a few strategies, figure out how to improve the results you’re getting.

In sum, you can position yourself to get in on investment opportunities by improving your finances so that you have enough capital to invest. You can improve your cash flow by reviewing your debt repayment process and by rethinking your approach to finances.

Speak Your Mind

You must be logged in to post a comment.