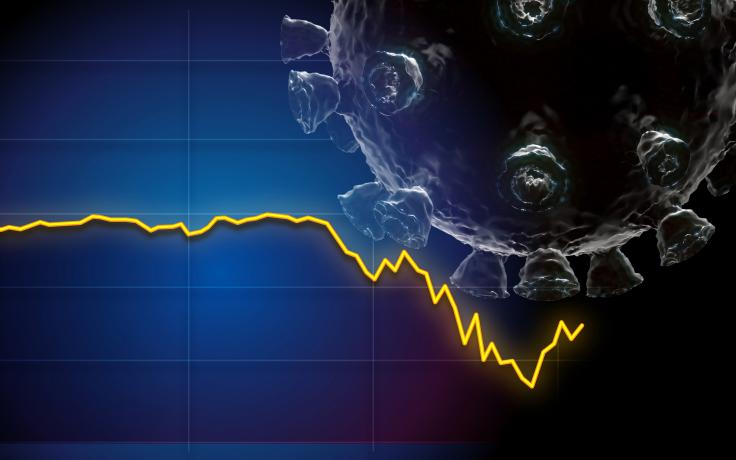

The global health crisis left a lot of people’s finances upside down. As if life before the pandemic wasn’t financially taxing enough, the changes to everyday life only exacerbated problems. Millions of people worked fewer hours or lost their jobs altogether. Although there was some financial assistance and leeway from the federal and local governments, it was barely enough to scratch the surface. As a result, they ended up falling into significant amounts of debt just to survive.

The global health crisis left a lot of people’s finances upside down. As if life before the pandemic wasn’t financially taxing enough, the changes to everyday life only exacerbated problems. Millions of people worked fewer hours or lost their jobs altogether. Although there was some financial assistance and leeway from the federal and local governments, it was barely enough to scratch the surface. As a result, they ended up falling into significant amounts of debt just to survive.

Survival Mode And Financial Decisions

When you’re trying to survive, all logic goes out the window. Your only objective is to ensure that you and your loved ones have the things you need. So, if you have to max out a credit card, default on a loan, skip a mortgage payment, or overlook a bill, you’re going to do what you believe is necessary. Although you know this is going to set you back, you figure you’ll cross that bridge when you get there.

Picking Up The Pieces

A year later and the pandemic continues, but things are starting to return to “normal”. COVID-19 vaccines are being distributed to the masses, simulating the hope of reducing mass outbreaks. With this hope comes the loosening of restrictions and the reopening of businesses nationwide. As time goes on, the financial assistance and leniencies that were afforded to you will be removed. If you’re not prepared, this could be a massive undertaking in the years to follow. The best thing you can do is use solutions like these to bounce back.

Calculate Your Debt

The first thing you have to do is calculate your debt. How much debt did you accumulate since the start of the pandemic? Gather your receipts, account statements, bills, and credit reports to get a proper understanding of what it will take to get your debt under control. Although this number may be alarming, you can resolve it more efficiently when you are realistic about the damage.

Contact Creditors

Although creditors, lenders, and service providers are aware of the financial struggles consumers face during the pandemic, you must reach out to them. Reaching out lets them know that you’re aware of your financial responsibilities and interested in resolving the matter as soon as possible. Explain your circumstances and find out what they can do to assist you. They may be willing to lower interest rates and payments, eliminate late fees, or offer a settlement amount you can repay quickly.

Stimulus And Tax Returns

If you’re going to pay down your debts and get back on track, you may have to make some tough decisions. One of those decisions might be using your stimulus payments or tax returns to pay down large balances. Any time the federal government issues you a check during the pandemic, apply it to your list of debts in order of importance. You can also work with professional tax prep services to get the most significant return possible to use for debts or rebuilding your savings.

Work For It

Sometimes, rebuilding your finances requires hard work. If you’ve fallen into a deep hole during the pandemic, you may have to find ways to earn some extra cash. You can ask your employer for additional hours, try applying for a promotion, taking on a second job, or developing a side gig. Yes, you’ll have to put in extra time and energy, but if it generates enough income to get you out of debt, then it’s worth the commitment.

The coronavirus pandemic did more than put everyone’s health at risk; it also crippled their finances. As the world strives to return to a sense of normalcy, digging yourself out of the hole is a must. Although it may seem like this is an impossible feat, there are efficient solutions you can implement. Use the suggestions provided above to begin the process of digging yourself out of debt, rebuilding your savings, and preparing financially for whatever the future may hold.

Speak Your Mind

You must be logged in to post a comment.